- Home

- Market Related

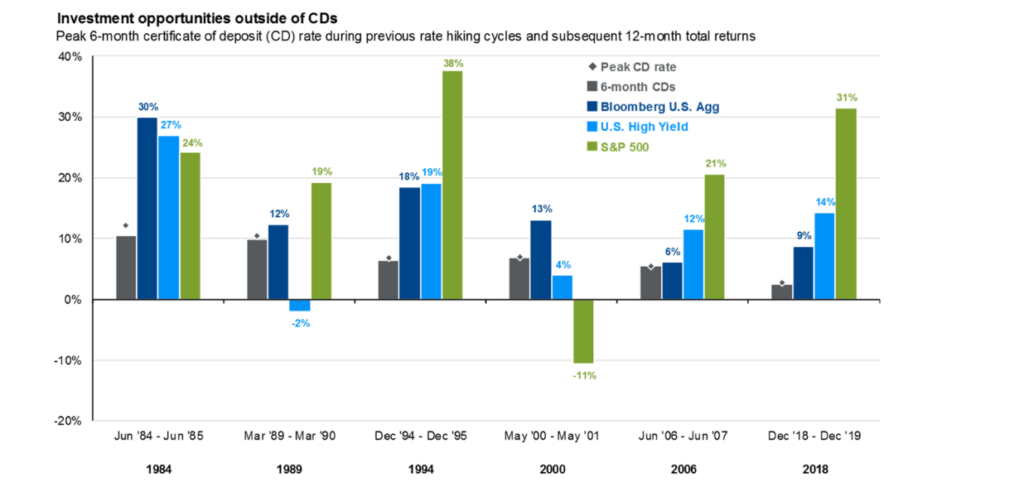

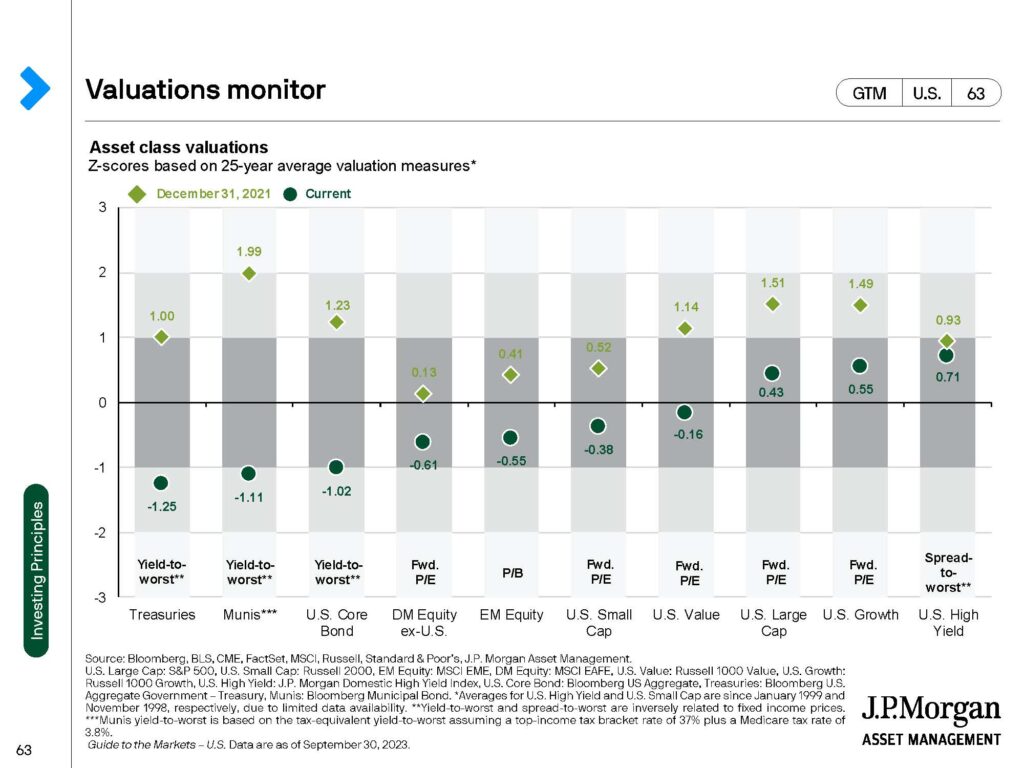

In this week’s episode of Matt’s Minutes, Matt is starting a two-week, two-part series titled “Staying the Course with Your Investments.” In today’s video, Matt shares an interesting visual that shows what a difference a year can make, comparing returns in 2022 compared to 2023. Showing us that the quote “it’s darkest before dawn” holds true in this case. Also enforcing the importance of staying committed to our investments, even during challenging times. Click on the video above to watch the full video.