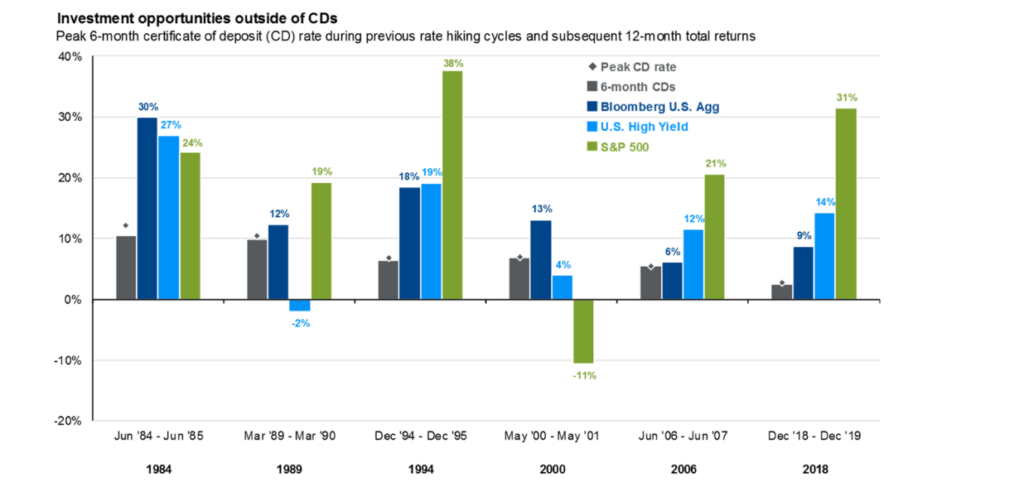

In today’s episode of Matt’s Minutes, we are talking about CD rates, which are currently favorable. But it is crucial to consider potential shifts in other areas of the market for investment options for long-term growth. In this interesting visual I share, we can see from history that when CD rates were at their peak, other areas of the market might have been a better place to invest one year later. Click play above to watch the full video.

Fundamentals of Finance

Will you to stop going to Starbucks?

By Hannah Elzea

In this episode of Matt Minutes I am using a very basic analogy pertaining to shopping and how it can affect the markets more than the news that we hear or read about. It’s alright to be concerned about things going on around us, but you need to make sure to put it into perspective.

Takeaways: Don’t let the current crisis of the day, week, or month derail your long-term investment plan. Or, better yet, don’t let your personal convictions and emotions dictate your financial decisions. While staying informed about current events is crucial, it’s equally important to remember that the market is influenced by a multitude of factors, not just the latest headlines. It’s important to maintain a rational and objective approach when it comes to investing.

Story time with Uncle Matt- A Tale of 5 Investors

By Hannah Elzea

- Home

- Fundamentals of Finance

In this episode of Matt’s Minutes, Matt shares a captivating story about five investors who each received a cash gift from their fairy godmother to invest. While some made thoughtful, strategic decisions that grew their wealth, others made choices that didn’t have the same positive outcomes. Tune in to the video above to explore the different paths these investors took and the lessons they learned along the way.

The Vehicle vs The Road

By Hannah Elzea

- Home

- Fundamentals of Finance

In today’s episode of Matt’s Minutes, Matt shares an analogy that connects to your finances and long-term goals. Rather than focusing solely on the specific investment (the “vehicle”), it’s more important to focus on the overall journey (the “road”) and the path to your financial future. This shift in perspective can help guide you toward better, long-term financial planning.

Is hindsight really 20/20 vision?

By Hannah Elzea

- Home

- Fundamentals of Finance

In today’s episode of Matt’s Minutes, we’re diving into the concept of hindsight and asking, “Is it really 20/20?” While hindsight gives us a clearer view of past decisions, the decision-making process itself is what truly shapes our outcomes. In this video, Matt explores how seeking wise counsel can lead to more informed choices and better results. If you’re navigating important decisions, don’t hesitate to reach out for the support you need on your journey.

The Pain of Loss vs. The Pleasure of Gains

By Hannah Elzea

- Home

- Fundamentals of Finance

In today’s episode of Matt’s Minutes, we dive into the concept of loss aversion—a powerful psychological principle that explains why the fear of losing often outweighs the pleasure of winning. A study referenced in this video reveals that, on average, people need to win twice as much as they lose to justify participating in any venture with risk. In other words, the emotional sting of a loss can be twice as painful as the thrill of a win.

Understanding loss aversion is crucial in assessing your risk tolerance—how much risk you’re willing to take in your investments and financial decisions. This episode will provide valuable insights into how this behavior impacts the way we approach investing.

To help you assess your own risk tolerance, we’ve attached a unique and fun risk questionnaire for you to take. By answering a few simple questions, you’ll gain a better understanding of your personal appetite for risk. After completing the questionnaire, feel free to email us your risk score or letter at Help@rossfinancialinc.com—we’d love to hear your results and help you apply them to your investment strategy!