- Home

- Timely Topics

This week, Hayley highlights a serious and growing concern: financial scams are becoming more sophisticated—and more personal. She walks through two real-world examples of individuals who were contacted by scammers posing as federal agents and financial professionals. These criminals convinced their victims to liquidate investment accounts and convert funds into untraceable assets like cryptocurrency and physical gold.

Scams like these prey on fear, urgency, and trust. They often involve pressure tactics and claims that your accounts have been compromised, your identity has been stolen, or a loved one is in danger.

Here at Ross Financial, we take these threats seriously. That’s why, if you ever call to request a withdrawal, you might notice we ask a few extra questions. It’s not to pry—it’s to protect you.

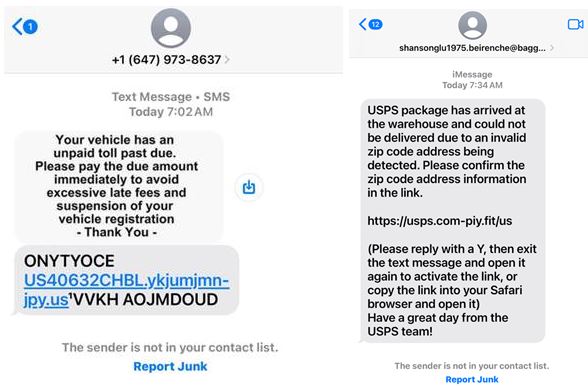

In addition to the examples shared in the video, we’re also seeing a rise in Text Message scams. These come through as text messages claiming you owe a small amount for an unpaid toll or requesting you to take some sort of action by clicking on an external link or “pay now.” It might seem harmless—but clicking that link could expose your personal information or install malware. (We’ve included a screenshot below, so you know what to watch for.) Don’t click on the link and report as junk!

Scammers are getting smarter, stay vigilant. Watch the full video to learn what red flags to look out for—and how we’re working behind the scenes to keep your finances safe.

The articles referenced in Hayley’s video are linked below for your reference:

📄 #1 – Florida Woman “Federal Agent” Request

📄 #2 – Gold Bars Scam

If you ever feel uncertain about a financial request or transaction, please don’t hesitate to contact us. We’re always here to help!