- Home

- Retirement

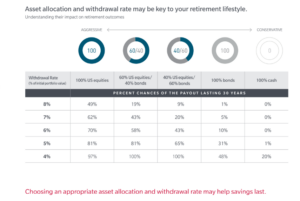

When planning for retirement, two important questions to ask yourself are: Am I taking on too much risk—or not enough? And what is a reasonable withdrawal rate to pull from my investment accounts?

In this video, I walk through a great visual tool that helps you self-analyze your current or future withdrawal rate. It provides a clear picture of how your investment strategy may play out over the next 30 years—helping you see whether you’re on track to have money left over.

Here at Ross Financial, our goal is to help you position your investments according to your long-term goals and risk level—not based on short-term emotions or current events.

This is a great resource to share with friends, family, or colleagues who may also be wondering if they’re striking the right balance between risk and security.

Click above to watch the full video!

And of course, your unique situation may require a conversation—if you’d like help evaluating your withdrawal rate or adjusting your strategy, we’re happy to assist. Just reach out!